In enhancement to the sorts of responsibility insurance discussed above, some states call for uninsured vehicle driver insurance coverage and/or underinsured motorist protection. Without insurance motorist protection might help spend for your medical or cars and truck repair service expenditures if you're the target of a hit-and-run mishap or one brought on by a vehicle driver that does not have obligation insurance.

In states with no-fault insurance legislations, each driver's insurance firm assists cover their very own clinical expenses, no matter that's at fault. If your vehicle is harmed in an at-fault state, repair services might be covered one of two ways. car. If the various other motorist is at mistake, their property damage obligation insurance might help cover the costs.

If you don't have crash insurance coverage, you'll require to pay out of pocket. Responsibility insurance policy is needed by regulation in 49 states and also Washington, D.C. The only state that doesn't need responsibility insurance is New Hampshire. Instead, New Hampshire chauffeurs require to show they're able to provide adequate funds to cover accident expenses if they're at fault in a crash.

Inspect with your state's transportation agency or insurance commissioner to find out the minimum restrictions needed in your state. In states where this kind of insurance policy is necessary, there are minimum protection needs.

However a higher obligation restriction can conserve you money if you trigger a mishap that leaves you on the hook for a reasonable quantity of damage or significant injuries. An insurance coverage representative can help you figure out the correct amount of car insurance protection for your requirements. As well as bear in mind that prices will differ depending on the insurance policy supplier you choose.

Our What Is Liability Car Insurance Coverage Ideas

Required car insurance policy? He appreciates offering readers with details that can make their lives better as well as more expansive (car).

Every state that mandates automobile insurance needs motorists to have a minimum quantity of obligation protection, It's an excellent suggestion to acquire even more liability insurance than just your state's minimum, so you're not on the hook for paying 10s of hundreds of dollars out of pocket after a mishap, If someone borrows your cars and truck, your liability protection additionally reaches them.

Physical injury liability insurance, Physical injury obligation insurance coverage covers the cost of the other motorist's injuries if you're in an at-fault crash - prices. That implies if you trigger a car mishap, physical injury obligation insurance would secure you versus the victim's insurance claims for expenditures after the accident, such as their medical bills, lost salaries, discomfort and also suffering, and in some cases lawful fees associated with injuries.

Building damage liability insurance coverage, Home damage responsibility insurance coverage pays for the damage you cause to another person's residential property with your car. Normally, home damage responsibility insurance covers fixing and/or substitute for damages you cause to the other individual's vehicle, yet it can also spend for damages to a residence, structures, lampposts and also telephone poles (insurance companies).

** Rather of automobile insurance coverage, Virginians can choose to pay the Virginia DMV $500 to legally drive on public roadways. What is no-fault liability automobile insurance policy?

Not known Details About Vehicle Liability Insurance Requirements - State Department

cars business insurance prices risks

cars business insurance prices risks

Often asked questions, What is the difference between responsibility insurance vs. complete insurance coverage? Obligation insurance coverage is called for in many states, and it covers the price of property damages as well as bodily injury to the other chauffeur as well as their lorry if you're at fault for a crash. Some vehicle drivers select to get just liability insurance coverage, in order to satisfy their state's demands.

These problems can include medical expenditures, shed incomes as well as lawful charges, as well as discomfort and also suffering. Property damage responsibility - Covers problems the insured person is legally obliged to pay, including fixing the other event's lorry as well as various other home damage to things such as structures, fences and signal lights (affordable auto insurance).

money cheap auto insurance liability insured car

money cheap auto insurance liability insured car

The first figure is the optimum amount the firm will certainly spend for a solitary injury at $25,000; the second figure is the optimum amount the company will pay per accident for all injuries at $50,000; as well as the third figure is the maximum amount the firm will certainly pay per mishap in residential property damages at $15,000 - accident.

The Insurance policy Info Institute suggests that chauffeurs lug obligation protection that is no much less than $100,000/ 300,000/ 50,000. Other insurance policy sector specialists likewise advise getting a minimum of $50,000 in building damages liability protection. suvs. If the total assets of the person at fault is significantly even more than the necessary minimums, they can be held personally liable for quantities over what the insurance coverage covers.

Liability protection is one of the most usual and vital types of car insurance policy (prices). Liability insurance coverage is vehicle insurance policy protection that's necessary in a lot of states.

7 Easy Facts About Texas Liability & Minimum Liability Insurance Coverage Explained

You can seek recommendations from your insurance coverage representative if you desire to understand even more about auto responsibility protection or the minimal auto insurance demands in your state. What Is the Coverage Limitation for Auto Responsibility Insurance?

The initial two numbers are the insurance coverage limits for physical injury. The initial number describes the maximum amount your vehicle insurance policy carrier will certainly pay for each injured person in the crash, while the second number is the optimum protection for the whole crash. The 3rd number is the coverage limitation for property damage.

How Much Responsibility Insurance Policy Do You Need? As long as you're bring the minimum quantity of car responsibility insurance coverage needed in your state, you aren't doing anything incorrect. credit.

cheaper car auto insurance affordable vehicle

cheaper car auto insurance affordable vehicle

This method, you'll have better satisfaction both on as well as off the road. Keep in mind that choosing greater coverage degrees will just slightly increase your auto insurance costs yet can possibly conserve you a great deal of cash as well as difficulty in the event of an at-fault accident. Below is an example that shows how a significant rise in responsibility coverage impacts an individual's vehicle insurance policy cost:25,000/ 50,000/ 10,000: $56.

Responsibility insurance coverage additionally will pay for your legal defense prices if you are taken legal action against as a result of your involvement with the crash. Who needs responsibility insurance policy? Anyone that drives a lorry requires Obligation insurance policy.

The Greatest Guide To What Is Liability Insurance And What Does It Cover? - Jerry

$30,000 would certainly be the most your insurance coverage would spend for all individuals injured in the crash. $10,000 would certainly be one of the most your insurance would spend for all home damaged in a single crash. With a combined solitary limit, or CSL, only one number is made use of to describe the restrictions for both Physical Injury insurance and Residential property Damages insurance policy.

If you selected a combined single limitation of $1 million, your insurance company would pay up to $1 million for all medical as well as injury-related costs and all building damages costs that you caused in an accident. Obligation insurance policy example: You can not stop your van in time, and rear-end the cars and truck in front of you.

Multiple lorries If one car on the plan has Liability insurance policy, all of the automobiles need to have it. State minimums Each state establishes legislations concerning how much Liability insurance its citizens are needed to have.

When it involves finding the best vehicle insurance coverage plan for you, it is essential to recognize the different kinds of insurance coverage and how much you truly need. Among your initial decisions will certainly be whether you want responsibility or full-coverage auto insurance. To simplify, responsibility insurance covers damage you do to others, while full insurance coverage policies cover both your obligation and also home damage to your very own car - cheap.

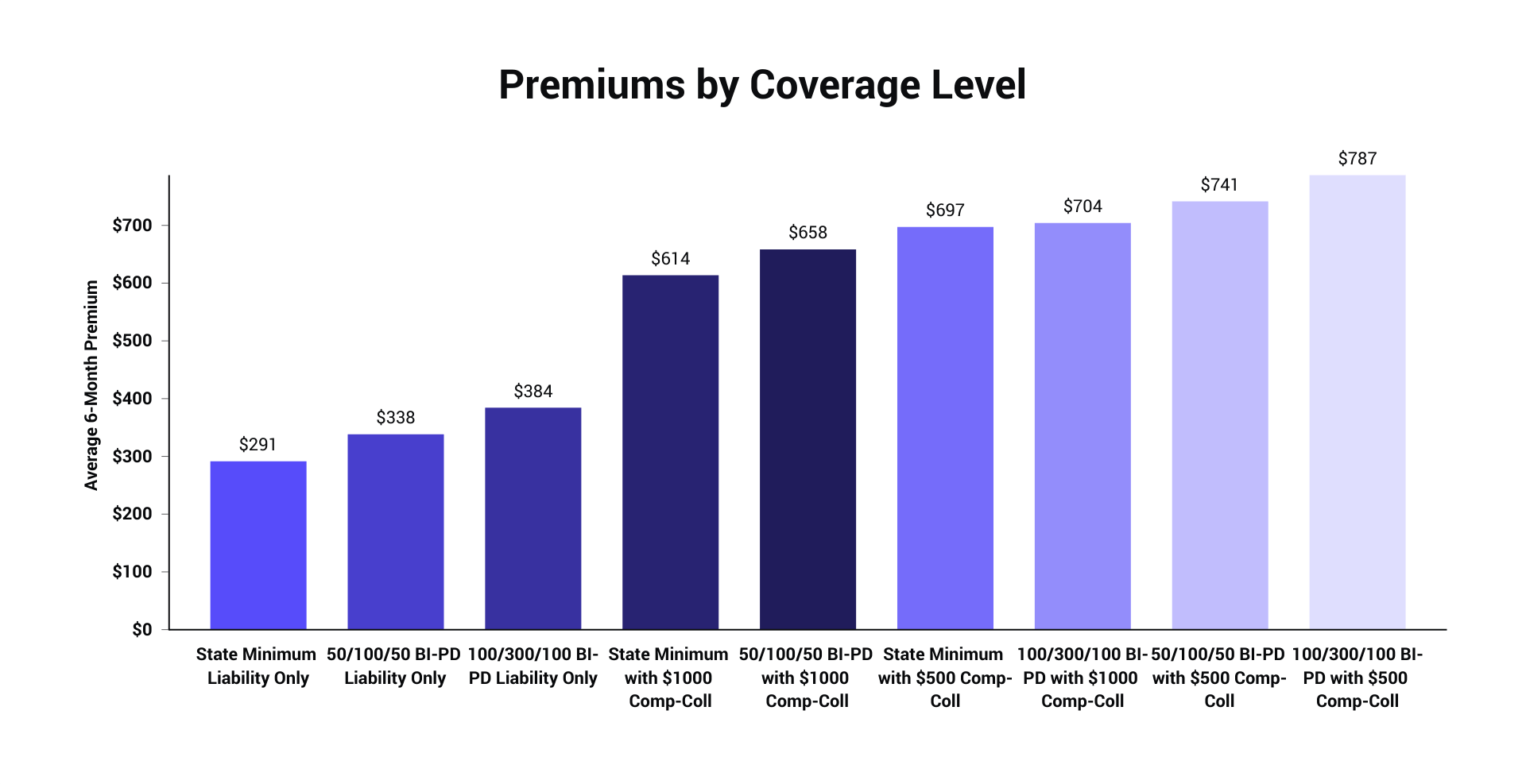

Responsibility vs complete insurance coverage insurance price Generally, we found you could conserve virtually $1,500 when you purchase minimal responsibility protection instead of a plan that consists of extensive and also collision insurance as well as higher liability restrictions (cheapest car insurance). These vehicle insurance coverage prices are based upon a 30-year-old male as well as reveal the price difference between complete insurance coverage as well as liability.

Not known Facts About Your Guide To Understanding Auto Insurance In The ... - Nh.gov

What is obligation insurance coverage vs. full insurance coverage? Obligation insurance policy will certainly cover damage to other automobiles or injuries to various other individuals when you're driving - cars.

cheapest auto insurance cheap car trucks trucks

cheapest auto insurance cheap car trucks trucks

Complete protection a shorthand name for policies that include thorough and accident insurance coverage is never called for by state regulation, yet your lender may require it if you rent or fund your auto. What is obligation insurance coverage? is needed by most states and covers the expense of damages as well as injuries to others you trigger in a crash - affordable.

Responsibility coverage is split right into 2 various components: as well as (insurance). will certainly cover the cost of the various other person's injuries if you are at fault for the crash, approximately the plan's restrictions. Policy limits normally show 2 numbers: The maximum amount paid per individual harmed in a crash The optimum quantity spent for the entire mishap Normally, the overall amount is dual the per-person limitation.

pays for damages to other cars or residential or commercial property when you are at mistake. The policy restriction for this kind of insurance coverage is noted as a single buck amount, which stands for the optimal payment per crash. Nevertheless, this does not cover damages to your very own lorry. If you stay in a state that does not call for vehicle insurance coverage, fresh Hampshire or Virginia, you're still economically liable for injuries and building damage resulting from an accident.

What is full-coverage insurance? does not mean a policy has https://carinsurancepaloshills.z1.web.core.windows.net all the bells and whistles. This term describes plans that consist of obligation protection along with. covers you in circumstances where you are driving and also your vehicle is damaged by an additional lorry or things, despite that is at mistake.

Some Known Details About Shopping For Auto Insurance: What To Know Before You Buy A ...

This shields the lender because you'll be able to fix the asset that secures the lending (your vehicle). If you have your automobile outright, you have no responsibility to get full protection. Nonetheless, if you have a newer car or one that still has significant worth, complete protection may be worth the investment to shield you against high expenses after an accident.

If your existing vehicle is worth even more than the consolidated cost of a full-coverage policy as well as deductible, full insurance coverage might be worth the cash. Say your automobile is currently worth $25,000, and also your vehicle is totaled in an accident with a tree. Collision insurance would cover the complete $25,000, minus your deductible.

As a general policy, complete insurance coverage prices motorists regarding $1,000 each year, so those who have useful cars can save themselves from some massive expenditures (vehicle insurance). If your car deserves much less than the price of full insurance coverage, you might wish to choose liability-only coverage, as your will certainly be a lot reduced.

These prices were openly sourced from insurance provider filings and should be made use of for comparative purposes just your very own quotes might be various (cheaper car insurance).