The driver would just pay their insurance deductible. When you don't need to pay an auto insurance coverage deductible, There are certain situations when individuals do not have to pay an automobile insurance coverage deductible. If an additional driver triggers a collision and their insurance policy pays In a lot of states, a driver that is responsible for triggering an accident is obliged to pay for all damages connected with the accident.

Nevertheless, if somebody's own automobile is also damaged in the very same event and they intend to make a case for repair work under their collision coverage, their deductible will apply. If the details sort of damages does not need paying an insurance deductible Sometimes, specific losses are covered without an insurance deductible.

If someone went with no deductible when purchasing insurance coverage Insurance companies may allow individuals to choose coverage with a $0 insurance deductible. If someone has no deductible, they won't owe anything out of pocket when a covered case takes place - insurers. Remember, however, the price of auto insurance will certainly be greater if a person selected a no-deductible policy.

Generally, chauffeurs need to choose an insurance deductible for comprehensive coverage, crash insurance coverage, and personal injury defense. What's the average auto insurance policy deductible? The ordinary car insurance policy deductible is $500. People can choose a deductible quantity anywhere from $0 to $2,000 with most insurance companies. Exactly how a lot of an insurance deductible should I pick for my auto insurance? The goal when getting an car insurance policy quote is to obtain high quality and also economical insurance - cheapest car.

Not known Factual Statements About Read This Before You File A Claim - Mcclain Insurance Services

auto perks cheapest car cars

auto perks cheapest car cars

Threat tolerance, When choosing a policy with a greater deductible, individuals take a larger danger. Those who aren't comfy taking that chance might desire to pay higher premiums to pass even more of the danger of economic loss on to their insurance policy service provider - auto insurance.

Those who often tend to have actually little money conserved for unanticipated costs may wish to choose a reduced insurance deductible. People with a hefty reserve can probably manage to take a possibility of sustaining greater out-of-pocket prices if they make an insurance coverage case. affordable car insurance. The probability of a claim, The more likely it is somebody will certainly make a case, the lower they need to establish their deductible.

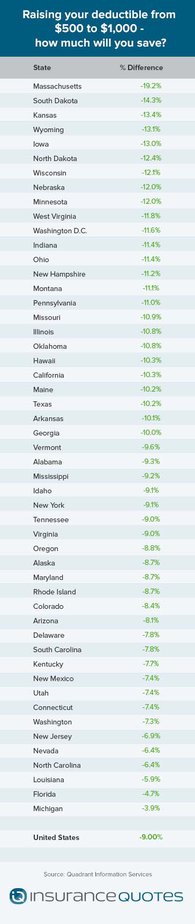

If the chances of a protected occurrence are unlikely, a motorist might be better off maintaining their costs reduced. Some individuals can conserve around $220 yearly on thorough as well as collision coverage by switching over from a plan with a $50 insurance deductible to one with a $250 deductible. By placing the costs cost savings right into a bank account, an individual could have enough cash in around a year to cover the included insurance deductible amount.

As long as a motorist doesn't get into an accident in less than a year, they 'd be better off. The worth of the automobile, If a vehicle isn't worth much, it might not pay to have insurance coverage with a high deductible. Claim a vehicle driver selects accident insurance coverage with a $1,000 deductible and their vehicle is only worth $1,000.

About Should I Have A $500 Or $1000 Auto Insurance Deductible

In this situation, the chauffeur would certainly be much better off forgoing collision insurance coverage completely. Just how to prevent paying an auto insurance deductible, The very best way to avoid paying a cars and truck insurance policy deductible is to prevent crashes, theft, or damage. Technique protective driving, comply with the customary practices, obey the rate limit, as well as avoid driving in bad climate.

People can likewise pick a policy with no insurance deductible, albeit at a higher cost. affordable auto insurance. Or they can register for a vanishing or going away deductible with insurance providers that supply it. This will minimize the quantity of the deductible by a set amount throughout each period the vehicle driver is totally free of accidents (cheap insurance).

Learn what a car insurance policy deductible is and also just how it influences your automobile insurance protection. The trick is knowing what deductibles and also coverages are and also how they impact auto insurance policy.

What is a deductible? Simply put, an insurance deductible is the amount that you consent to pay up front when you make an insurance claim, while the insurance company pays the remainder as much as your protection restriction. When choosing your cars and truck insurance policy deductible, think of just how much you agree to pay of pocket if you require to make an insurance claim.

The Best Guide To Collision And Comprehensive Insurance Explained - Time

Without insurance driver This insurance coverage Look at more info pays for damages if you or another covered person is hurt in an automobile accident triggered by a chauffeur who does not have obligation insurance. In some states, it might additionally pay for property damages.

Underinsured motorist insurance coverage is subject to a policy limits selected by the insured. Rental reimbursement This protection pays for rental expenses if your car is impaired due to a covered loss.

You must pay your automobile insurance coverage deductible for the case to be complete. Do not send out in your claim to your insurance policy business if you can not pay your insurance deductible.

cheaper cars accident prices insurance company

cheaper cars accident prices insurance company

There are two various other types of insurance coverage that make use of deductibles:- PIP covers clinical bills for you and your travelers.- This kind of insurance coverage protects you when you're struck by a motorist who does not have insurance policy.

More About How Much Car Insurance Do I Need? - Ramseysolutions.com

Typically, it works one of two methods: Your insurance coverage firm subtracts the insurance deductible from your case payment. Allow's state your claim is approved for $2,500 and your deductible is $500.

- Some auto mechanics are open to exercising a monthly strategy. You after that pay them regular monthly until your deductible is paid off. It assists if you have a lasting organization relationship with your mechanic as well as can reveal an honest need. - Obtain a finance at a bank or ask a member of the family or friend.

There's no pity in requesting for aid when in demand. Establish up a sensible settlement strategy and also stay true to it. If you remain in a situation where you can not pay your insurance deductible there some points you can do. You need to find a method to pay your insurance deductible.

- A few states use the alternative of picking a $0 insurance deductible on thorough insurance coverage. - For any glass damages that can be fixed instead of replaced, you may not need to pay a deductible.

The 7-Minute Rule for How To Save On Car Insurance: Smart Ways To Lower Your Rate

cheap auto insurance automobile auto credit

cheap auto insurance automobile auto credit

Listed here are various other points you can do to lower your insurance coverage expenses. 1. Look around Rates differ from firm to business, so it pays to look around. Obtain at the very least three estimate. You can call companies straight or accessibility info on the web. Your state insurance coverage department may additionally provide contrasts of costs charged by major insurance providers - dui.

It's important to pick a company that is economically stable. Obtain quotes from various kinds of insurance coverage firms. These companies have the same name as the insurance policy company.

Ask close friends and also family members for their suggestions. Get in touch with your state insurance policy department to locate out whether they supply info on customer grievances by business. Choose a representative or business agent that takes the time to address your concerns.

2. Prior to you buy a car, contrast insurance coverage prices Prior to you acquire a brand-new or used auto, inspect right into insurance policy prices. Auto insurance premiums are based in part on the vehicle's price, the cost to fix it, its general safety record as well as the probability of burglary. Several insurance companies provide price cuts for attributes that lower the threat of injuries or theft. laws.

Not known Facts About How Much Car Insurance Do I Need? - Ramseysolutions.com

Testimonial your protection at revival time to make certain your insurance coverage requirements haven't altered. 5. Purchase your homeowners as well as vehicle insurance coverage from the same insurance company Lots of insurance providers will provide you a break if you acquire two or even more kinds of insurance policy. You may additionally get a decrease if you have more than one lorry insured with the same company.

Ask regarding team insurance coverage Some firms use decreases to motorists that get insurance coverage with a team plan from their employers, via professional, organization and also alumni teams or from other associations (insurance). Ask your company and inquire with groups or clubs you belong to to see if this is feasible.

Seek other discount rates Business provide price cuts to policyholders who have not had any accidents or relocating offenses for a variety of years. You might likewise obtain a discount if you take a protective driving program. If there is a young driver on the plan that is a great trainee, has actually taken a drivers education and learning training course or is away at college without an automobile, you might likewise get a lower rate.

The key to savings is not the price cuts, yet the last cost. A firm that provides few discount rates may still have a reduced general cost. Federal Resident Information Center National Consumers League Cooperative State Study, Education And Learning, and also Expansion Service, USDA.

Fascination About What Happens If You Can't Pay Your Car Insurance Deductible?

You have wide crash coverage, If you have broad collision insurance coverage you may be able to have your insurance deductible waived: If you are much less than half in charge of the collision, If you are greater than one-half liable, the insurance deductible stands and you have to pay it - cheaper. If the various other person in the accident is entirely at fault, that person's insurance policy will generally pay all fixing fees, including what you would have paid for the deductible2.

CDWs do not pay if the individual that strike you includes you in a hit-and-run crash. 3. The various other chauffeur is uninsured, In some states you can purchase a without insurance vehicle driver protection-damage policy (UMPD), which covers you as much as a specified quantity if the various other motorist associated with the crash doesn't have auto insurance - low-cost auto insurance.

cars credit score risks accident

cars credit score risks accident

car insured dui cheapest car insurance vehicle insurance

car insured dui cheapest car insurance vehicle insurance

You submit an insurance claim with your insurer to cover the damage to your car. When you submit a car insurance policy claim, you require to pay a deductible before your insurer covers the remaining costs. Allow's say your automobile has $5,000 well worth of damage and you have a $1,000 insurance deductible.

As soon as you have actually paid the insurance deductible, the auto insurer will take over. Check out the regards to your insurance coverage to see to it you comprehend exactly how your deductible works. You Might Not Have to Pay Your Insurance Deductible in Specific Scenarios There are specific circumstances where you don't need to pay a deductible, consisting of: A Guaranteed Chauffeur Hits You and also Is At Fault If the other driver is found formally liable for the crash, then the other vehicle driver's insurance provider will pay for your repairs and you will certainly not have to pay your insurance deductible.